When Are 1099s Due 2024 – Due dates for supplying tax forms to the IRS may be different. Also, filing before your forms are in hand also sets you up for a potential audit. The IRS matches Forms W-2 and Forms 1099 to the . The deadline is January 31 for mailing 1099s to most taxpayers, but the IRS may delay that deadline in a given tax year. Others are due to the IRS at the end of February. Some payers send them .

When Are 1099s Due 2024

Source : blog.checkmark.comWhen To Expect Your Forms W 2 & 1099 In 2024—And What To Do If

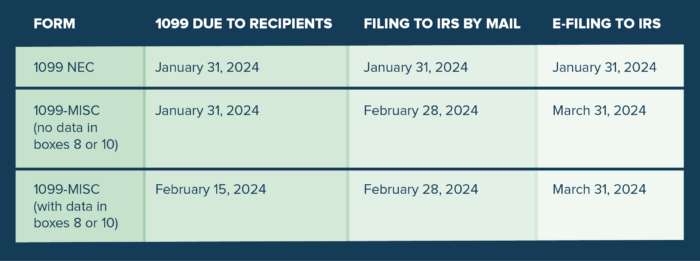

Source : www.forbes.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comWhen & How to file a Form 1099

Source : www.finaloop.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com2024 Form IRS 1099 MISC Fill Online, Printable, Fillable, Blank

Source : 1099-misc-form.pdffiller.comWhen Are 1099s Due 2024 How to File 1099 NEC in 2024 — CheckMark Blog: General 1099 Due Dates Payers must provide a copy of Form 1099 to the receiver of the income by Jan. 31. Also, Form 1099 must be filed with the IRS by Feb. 28. If more than 250 recipients of Form . If you’re one of the growing number of independent contractors, retirement planning can sometimes seem daunting given the lack of access to a traditional retirement account like a 401 (k). Fortunately .

]]>

.jpg)